La carta semanal de John Hussman es una de las más interesantes y recomendables para leer cada lunes.

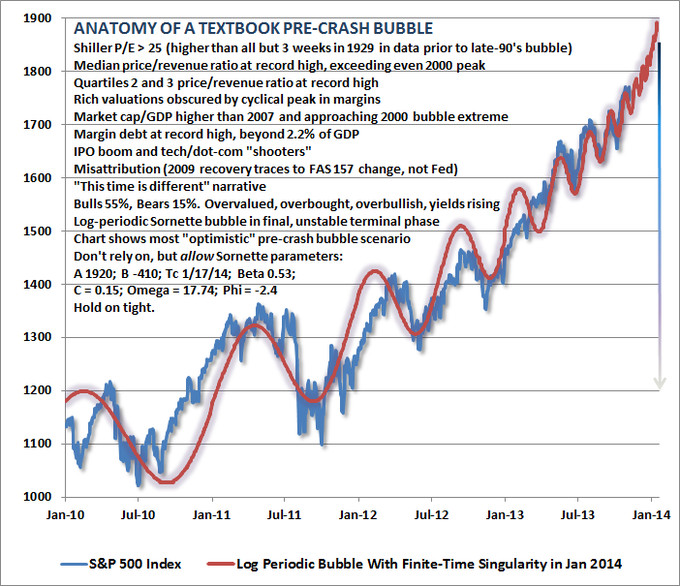

Aquí os dejo el enlace de la última carta y un gráfico de los buenos. De los que hablan pos sí solos. Pero mejor entrar en el enlace y leer con calma. Siempre se aprende algo nuevo.

http://hussmanfunds.com/wmc/wmc131111.htm

"Despite the unusually extended period of speculation as a result of faith in quantitative easing, I continue to believe that normal historical regularities will exert themselves with a vengeance over the completion of this market cycle. Importantly, the market has now re-established the most hostile overvalued, overbought, overbullish syndrome we identify. Outside of 2013, we’ve observed this syndrome at only 6 other points in history: August 1929 (followed by the 85% market decline of the Great Depression), November 1972 (followed by a market plunge in excess of 50%), August 1987 (followed by a market crash in excess of 30%), March 2000 (followed by a market plunge in excess of 50%), May 2007 (followed by a market plunge in excess of 50%), and January 2011 (followed by a market decline limited to just under 20% as a result of central bank intervention). These concerns are easily ignored since we also observed them at lower levels this year, both in February and in May. Still, the fact is that this syndrome of overvalued, overbought, overbullish, rising-yield conditions has emerged near the most significant market peaks – and preceded the most severe market declines – in history."