The doom of the car as an asset and why the general view of its future is wrong

The future of the car is probably one of the most amazing subjects of speculation that we can find in today´s world. At least four revolutions are happening simultaneously: connectivity, electrification, shared economy, and autonomous driving. All of them interlace, leverage each other and have profound implications on the business models of the coming 10 to 30 years.

In this article I want to focus only on how cars will be used once the four revolutions are completed and full automated driving (Level 5) is achieved.

The prevalent view has been a dismal future for the car as an asset class (the traditional ownership). Cars as a service and car sharing are perceived as the future and are being proposed by Daimler, BMW, Tesla, Uber, Lyft and a host of smaller companies worldwide. The most accepted scenario is that the advent of the autonomous car will make such services very attractive for the user and very lucrative for the providers and thus become ubiquitous.

The autonomous vehicle will be the catalyst that will allow the GIG economy to become extremely profitable and will generate two main alternatives: Robotaxis and AV Subscriptions (AV for autonomous driving).

The first alternative will be the result of the merger of the current taxis and car sharing services. Both will become the same service as the drivers are replaced by the autonomous vehicle. I.e.a Car2Go and an UBER will not be any different, once you take the driver out of the equation. Efficiencies in the rotation of the cars will not only allow the providers to become profitable but will also transfer part of the savings to the users that will have access to mobility at fraction of today´s cost.

The second alternative will be subscription packages. Subscription packages are currently being tested by Mercedes in certain towns in the US. The client pays a monthly subscription that allows him to have access to a predetermined set of cars. During the week he can drive a smaller car into the city, swap it for a large SUV for a weekend or for a two-seater convertible for a romantic escapade. Again, AVs will radically improve the offering and the economics of the service. Once the AV is fully capable the swap will be immediate as the car will drive to us and pick us up, bypassing the infrastructure currently provided by rental companies. We could subscribe to a car, or a combination of cars of our choice with absolutely no hassle at a reasonable price.

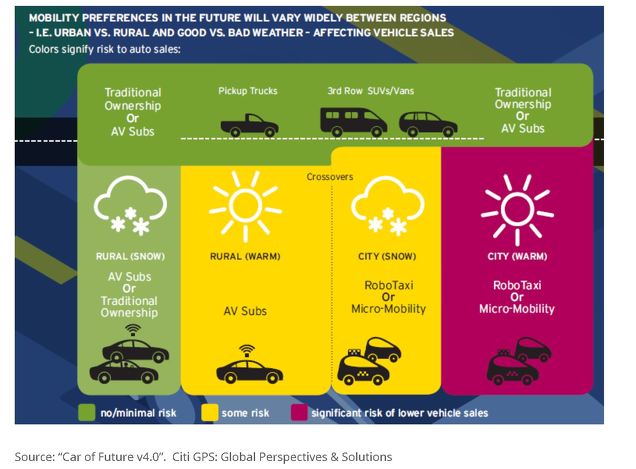

According to the conventional wisdom, under this scenario, the car “as an asset” will be relegated to the backstage. Its sales will be limited to eccentric collectors, car lovers and those very remote locations in which either the ruggedness of the road, the lack of a digital infrastructure or the small number of vehicles across large expanses, will still demand a physical driver and most likely an owner. Citibank on his work “Car of the future V4.0” limits this “traditional ownership” to pickups or commercial vehicles in which AV is optional.

Despite the strong arguments backing the above explained scenario, I believe there is too much emphasis on the economics and not enough on how we, humans, behave towards property. Precisely because the autonomous vehicle is going to allow the car to become much more than a car, the value of the car as an asset is not going to disappear and the value perceived in owning a car may even increase.

Please join me in a time travel 30 years into the future. The overall picture: Less cars; a lot of robotaxis and micro taxis in the cities; on the average only one car per household; average price: Almost twice a current car. But what an amazing car it will be! Just imagine what an AV car could do:

- First, we will be able to drive on journeys that today do not make sense. For example, leaving on Friday night to go skiing and sleep while the car drives, allows people to ski early Saturday and save the room fare at the hotel. The same on the way back. You can squeeze in every run on Sunday until the lifts are closed and rest on the way back. Also, vacation trips, second homes, etc., are suddenly appealing for a weekend or a short trip even if they are 6 to 10 hours away.

- Secondly, we will be able to work from the car. The onboard computer will surpass the combined power of both the one at your office and the one at your home. Such a piece of hardware and software will allow us to work 100% connected while simultaneously drive our car. It will have the same files, facilities, software, data and tools that we have at our place of work and a much more demanding cybersecurity package; we cannot afford our car to be hacked while driving. There will be the added layer of a voice interface that will suppress the need of typing while moving. Moreover, it will have all the entertainment features from home, for those long drives to a second residence, or ski resort that now can take place while you rest or sleep. Most likely, the voice interface of the car will be the same one that we use in other environments (house and office). Thus, explaining the ferocious battle between the Siris, Alexas, Cortanas and Bixbis of this world to conquer the house voice interface. And all of the above will be fully personalized to fit your preferences.

- Thirdly, the car will be our “chauffeur”. It will drive us anywhere and go back home and park himself, or take the kids to school, drop our partner at his/her work, pick up the shopping from an automated pick up facility, and pick us up again when we’re done. It will do the work of two to three cars. It will listen to our conversations with a knowing smile, record everything we say, type or do, and keep it under an unbreakable vow of silence and loyalty for further use.

- Lastly, the size and shape of the car of the future will likely be completely different. The ability of the car to return to its “docking station” and park itself will allow for larger cars (no problems finding a parking slot). Fully electric or hydrogen fuel cell engines will liberate a lot of space and allow for a flat floor in which setting up working, driving or sleeping quarters will be easier and much more comfortable. The car may resemble the cabin of a small luxury yacht or a REV more than the tiny inner space of a current car and would likely be priced like houses and boats: by the square feet. Image, design, exclusivity, differentiation will have increasing importance in a space so personal that integrates home, sleeping quarters, office and mobility.

And as it happens with houses and yachts, people will invest insane amounts of money in their cars to customize them with the best available design and features. Cars will remain one of our priciest possessions and the personification of our success. Frankly, I do not see their appeal as an asset diminishing at all.

Javier Herreros de Tejada

BrightGate Advisory EAF