El Beige Book es una fuente de información sobre la economía estadounidense muy interesante y a la vez muy infravalorada. En una época donde predomina lo cuantitativo, una falsa precisión en el uso de cifras, este documento queda en un segundo plano ya que se trata de una descripción de las últimas tendencias y fenómenos económicos recogidos por los analistas de la Reserva Federal. Su informe no provee estadísticas, tablas o números, tan solo describen detalles que se observan desde diferentes ángulos de la economía americana. De tal modo que, en vez de colocar en medio de la página un gráfico o una tabla sobre un dato, simplemente menciona lo que observan los analistas y los que recogen los datos. Veamos un extracto del informe de junio:

Slight growth in wages was reported by most districts. A tight market for skilled construction labor in the Boston, Dallas, and San Francisco Districts pushed up wages for workers there, and staffing services firms in Boston, New York, and Dallas noted rising wages. The Richmond, Kansas City, and San Francisco Districts noted higher wages in the restaurant and/or hospitality industries. Some contacts in the IT sector in the San Francisco District reported rapid wage gains, and their counterparts in Boston noted rising wages as well. Employers in the Atlanta District were monitoring how recent minimum pay announcements from a number of employers would affect local labor markets. Contacts across various industries in the Chicago District reported a willingness to raise wages when necessary to attract and retain workers, and a notable share of reporting firms in the Minneapolis District also said they were increasing starting pay for most job categories to attract new hires.

[...]

The labor market has shown signs of leveling off since the last report. Fewer contacts in both manufacturing and other sectors report that they are expanding employment, on net, though a sizable proportion of service-sector firms plan to expand employment in the months ahead. One major New York City employment agency reports that hiring activity has slowed somewhat from the brisk pace seen in March but that the job market continues to improve at a modest pace, with slight upward pressure on salaries. The pool of job candidates remains tight--particularly for IT workers--with one contact noting that candidates from outside the New York City area are deterred by high housing costs. A trucking industry contact also notes an ongoing widespread shortage of drivers.

Beige Book - June 3, 2015

En resumen, el informe dice que hay un leve crecimiento de los salarios en la mayoría de distritos. Existe escasez de trabajadores cualificados en construcción y los salarios de estos perfiles crecen más. También se observan presiones al alza en los salarios relacionados con la industria de la tecnología de la información (IT) en San Francisco y Boston. Los salarios también destacan al alza en la hostelería en varios distritos. Además, en no pocas industrias existe la expectativa de subir salarios en los próximos meses para atraer y mantener trabajadores. Finalmente, uno de los contactos también señala que existe cierta escasez de conductores para camiones en la industria del transporte.

Desde el punto de vista cuantitativo la información de este documento no se puede incorporar a una hoja excel o tomar los datos para buscar correlaciones, prácticas muy extendidas. Sin embargo, en este párrafo se mencionan detalles muy interesantes sobre lo que se está observando en el mercado de trabajo.

Lo realmente interesante es que en informes anteriores se mencionan los mismos fenómenos, con lo cual podemos intuir que son tendencias importantes. Sobre la escasez de trabajadores cualificados y el alza de sus salarios tenemos el Beige Book del 15 de abril de 2015:

Modest or moderate wage pressures were reported in several Districts including New York, Richmond, St. Louis, Kansas City, and San Francisco. Wage pressures in Atlanta were muted. Wage pressures in Cleveland and Chicago were more pronounced for skilled workers. However, Chicago noted that there were more reports of wage increases for unskilled workers than in the previous reporting period. Contacts in San Francisco noted some seepage of wage pressures that had been limited to higher-end jobs in urban areas into middle-tier jobs and smaller towns. In the Minneapolis District, the strong wage increases observed in the energy-producing region over the past few years have slowed, and in some cases, declined. Retail sector wages in Kansas City experienced a mild decline but are expected to grow in the coming months.

Beige Book - April 15, 2015

“Las presiones al alza de los salarios en Cleveland y Chicago fueron más pronunciadas para trabajadores de alta cualificación”.

Y el Beige Book del 3 de marzo de 2015:

Wage pressures were moderate across most Districts, but some contacts reported increased wages to attract skilled workers for difficult-to-fill positions. In particular, service sector firms in the New York District noted increasingly widespread reports of wage hikes. Contacts in the Cleveland, Richmond, and Kansas City Districts noted increased wage pressure due to the difficulty in attracting and retaining truck drivers. A staffing firm in the Chicago District reported some companies were also willing to raise rates for unskilled workers to reduce turnover, and contacts in the Atlanta District noted increasing entry-level wages.

Beige Book - March 4, 2015

“...pero algunos contactos informaron de mayores salarios para atraer trabajadores cualificados para puestos difíciles de ocupar.”

También en enero se observaban tendencias similares:

Significant wage pressures continued to be limited largely to workers with particular technical skills. Indeed, the Philadelphia, Cleveland and Chicago Districts noted that upward wage pressures tended to be limited to experienced and technically-skilled personnel. The Richmond District reported that overall wage pressures were mild during the reporting period and that average wage growth in manufacturing slowed somewhat. The Dallas District noted fewer reports of rising wage pressures than in the previous reporting period. In contrast, Kansas City reported that wage growth accelerated slightly, with many contacts citing labor shortages.

Beige Book - January 14, 2015

“Presiones al alza de los salarios corresponden en su mayor parte a trabajadores con habilidades técnicas específicas.”

El Beige Book no solo habla del mercado de trabajo. Por un lado tiene varios apartados por sectores y enfoques, y por el otro, realiza un informe por cada uno de los doce distritos de la Reserva Federal en EEUU. Es un documento muy completo donde se filtra mucho ruido y se destacan fenómenos concretos. Se centra en los hechos y se olvida de las proyecciones, prácticamente al revés de lo que suelen hacer muchos analistas. “Existen presiones al alza de los salarios por 8º mes consecutivo” es más relevante que “los salarios suben un 3% interanualmente”, en el primer caso se confirma una tendencia de forma paulatina mientras que el segundo es una estadística con menos contexto y sujeta a sesgos estadísticos.

En el fenómeno que hemos destacado en los extractos, lo relevante no es cuánto suben los salarios de los trabajadores de IT, sino que muchos empleadores anotan que tienen problemas para encontrarlos y por ello necesitan subir salarios. El primer dato sin contexto no es nada, el segundo indica una escasez relativa de mano de obra en un sector particular.

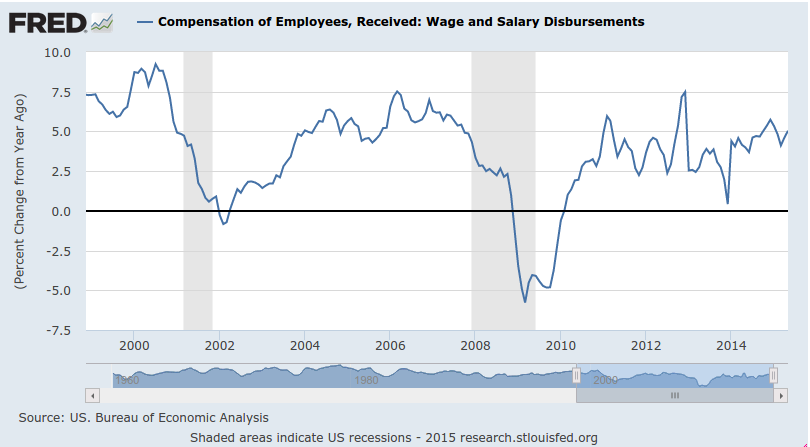

Esta información es importante porque los analistas han mostrado interés por la evolución de los salarios, y tras analizar el dato del salario por hora medio se muestran extrañados de por qué los salarios no terminan de despegar si el mercado laboral continúa mejorando.

Las tasas de crecimiento están muy por debajo de las tasas de ciclos anteriores, al menos en la segunda mitad de ciclo.

Otro ángulo es analizar el conjunto de los salarios nominales en vez de en promedio:

Observadas en conjunto, las rentas del trabajo aumentan a tasas similares al ciclo anterior, quizás a través de creación de empleo en vez de por subidas de salarios individuales.

Sin embargo, tras leer los extractos del Beige Book podemos intuir lo que está sucediendo. El Beige Book en términos prácticos separa lo que sucede en el mercado de trabajo de trabajadores cualificados de los no cualificados. Incluso algunas veces especifica más. Sí que existe una escasez de trabajadores y presiones al alza de los salarios, pero en sectores concretos. Sector servicios o tecnologías de la información (software, nuevas tecnologías) son los sectores que más trabajadores están demandando y eso coincide con los sectores que más se han expandido por volumen. Además, sectores que son un input para muchos sectores a la vez como el transporte también encuentran dificultad para contratar y mantener trabajadores (truck drivers). Lo cual es coherente con el dato de ofertas de empleo disponibles sin cubrirse creciendo:

Leyendo informes más antiguos de 2008 o 2009, lo que se observa es que la tendencia de aumento de salarios no es una cuestión reciente, sino que lleva años gestándose. En la mayoría de informes señalan que los salarios en los puestos de trabajo cualificados crecen. Incluso en algunos informes de 2009 en medio de una recesión, se anota que las condiciones laborales empeoran en general, excepto para perfiles cualificados o muy concretos. Es por ello una tendencia de largo plazo y no tanto una cuestión cíclica. Lo que sí es un dato cíclico es que algunas en perfiles de baja cualificación en sectores cíclicos comienzan a escasear en algunos distritos. Lo cual apunta a que en algún momento repuntarán los salarios de forma significativa.

La recolección y descripción de datos cualitativos e impresiones es una fuente de información muy infravalorada. En este artículo se han usado 4 fuentes de información, tres cuantitativas y una cualitativa. Esta última sintetiza lo que dicen las otras tres: sueldos subiendo y escasez de trabajadores muy concretos, sueldos planos o crecimiento leve en la mayoría de sectores. Es la más completa gracias al gran trabajo que realizan los analistas de la Reserva Federal a lo largo de los 8 distritos en EEUU.

Capacidad de predicción

¿Y qué capacidad tiene el Beige Book de captar tendencias en tiempo real sobre lo que sucede en la economía? Analicemos algunos informes de 2007 y 2008.

Reports from the twelve Federal Reserve Districts indicate that economic conditions have weakened since the last report. Nine Districts noted slowing in the pace of economic activity, while the remaining three--Boston, Cleveland, and Richmond--described activity as mixed or steady.

[...]

Labor markets were mostly described as weakening since the last report, though a few Districts reported ongoing shortages of skilled workers and some Districts noted wage pressures. Increases in input costs were widespread, accompanied by somewhat smaller rises in selling prices.

[...]

Housing markets and home construction remained sluggish throughout most of the nation, though there were few signs of any quickening in the pace of deterioration. Ongoing weakness in housing markets, in general, was reported in almost all Districts. Sales activity was generally reported to be declining in the Boston, New York, Philadelphia, Atlanta, St. Louis, Minneapolis, Dallas and San Francisco Districts, while Kansas City and Chicago noted slack demand and excess inventories. On the other hand, the Cleveland District saw some pickup in activity, while Richmond and Atlanta reported some pockets of improvement; Boston, Atlanta, and Chicago cited some recent pickup in traffic or buyer inquiries. New residential construction was reported to have remained at depressed levels, and none of the Districts reported any pickup since the last report.

[...]

Credit quality was reported to have deteriorated, on balance, since the last report. Increased delinquency rates were noted by New York, Philadelphia, and Cleveland, while Kansas City reported that loan quality remained lower than a year ago. Widespread tightening in credit standards was reported, especially on residential and commercial real estate loans. In general, banks were reported to be tightening credit standards in the New York, Cleveland, Atlanta, Chicago, Kansas City, Dallas and San Francisco Districts. In addition, Boston noted that standards remain tight on commercial mortgages, while Philadelphia indicated that banks are limiting lending in this category. Richmond indicated tighter standards on residential mortgages.

Beige Book - April 16, 2008

El informe en abril de 2008 habla de claro deterioro en casi todas las áreas, sobre todo en las principales. Dice que las condiciones económicas generales se han debilitado desde el anterior informe, las condiciones laborales han empeorado desde casi todos los ángulos y que la situación crediticia sigue empeorando claramente.

En el informe de marzo de 2008 todos los puntos son bastante negativos, no importa de qué sector estemos hablando. Algunos contactos señalan las condiciones crediticias están empeorando, otros un aumento del coste de las materias primas o simplemente una baja demanda en el mercado inmobiliario. A continuación algunos párrafos:

Reports from the twelve Federal Reserve Districts suggest that economic growth has slowed since the beginning of the year. Two-thirds of the Districts cited softening or weakening in the pace of business activity, while the others referred to subdued, slow, or modest growth. Retail activity in most Districts was reported to be weak or softening, although tourism generally continued to expand. Services industries in many Districts, including staffing services in Boston, port activity in New York, and truck freight volume in Cleveland, appeared to be slowing, but activity in services provided some positive news in Richmond and Dallas. Manufacturing was said to be sluggish or to have slowed in about half the Districts, while several others indicated manufacturing results were mixed or trends were steady.

Residential real estate markets generally remained weak; reports on commercial real estate markets were somewhat mixed, but also suggest slowing, on balance, in many Districts. Most Districts reporting on banking cite tight or tightening credit standards and stable or weaker loan demand. Districts reporting on the agriculture and energy sectors said activity is generally strong.

Upward pressure on prices from rising materials and energy prices was noted in almost all the District reports, but Philadelphia said increases in input costs and output prices had recently become less prevalent, and San Francisco indicated pressures were limited for products other than food and energy. By contrast, wage and salary pressures were generally said to be modest, as the hiring pace slowed in various sectors and labor markets loosened somewhat in many Districts.

[...]

Sales activity in nonresidential markets was down in the Boston, Dallas, Kansas City, and Chicago Districts, with contacts citing tight credit conditions as a major factor. Office sales activity remained strong, however, in the major cities of the New York District and in the San Francisco District. Eight of the twelve Districts reported that nonresidential construction activity was slow; countering these reports, the Cleveland, Dallas, and San Francisco Districts indicated that construction remained strong.

Beige Book - March 5, 2008

Veamos algunos informes adicionales para ver en qué momento este documento comenzó a anotar que la economía comenzaba a empeorar.

El informe de enero del 16 de enero de 2008 es muy revelador. En general muestra una tendencia positiva pero también una desaceleración notoria, con algunos sectores clave muy débiles y empeorando:

Reports from the twelve Federal Reserve Districts suggest that economic activity increased modestly during the survey period of mid-November through December, but at a slower pace compared with the previous survey period. Among Districts, seven reported a slight increase in activity, two reported mixed conditions, and activity in three Districts was described as slowing.

Most reports on retail activity indicated subdued holiday spending and further weakness in auto sales. However, most reports on tourism spending were positive. Residential real estate conditions continued to be quite weak in all Districts. Reports on commercial real estate activity varied, with some reports noting signs of softening demand. Manufacturing reports varied across industries, with pronounced weakness noted in housing-related industries as well as the automobile industry. Strong export orders and increased demand in industries whose products compete against imports was reported by some Districts. Demand for nonfinancial services remained generally positive, although some Districts commented on continuing weak demand for transportation services.

Beige Book, January 14, 2008

El informe de noviembre de 2007 muestra la misma impresión, solo que ligeramente más positiva. Habla de desaceleración y de un sector inmobiliario deprimido:

Reports from the twelve Federal Reserve Districts suggest that the national economy continued to expand during the survey period of October through mid-November but at a reduced pace compared with the previous survey period. Among Districts, seven reported a slower pace of economic activity while the remainder generally pointed to modest expansion or mixed conditions.

[...]

Demand for residential real estate remained quite depressed, with only a few tentative and scattered signs of stabilization amidst the ongoing slowdown. Most Districts pointed to further increases in the inventory of available homes, with the earlier tightening of credit conditions for mortgage lending continuing to create barriers for some buyers. Consequently, prices on new and existing homes sold were reported to be down on a short-term or year-earlier basis in most Districts. The pace of homebuilding remained very low in general, and builders continued to shelve projects and lay off workers in many areas; contacts generally do not expect a significant pickup in homebuilding until well into next year at the earliest. Among scattered positive signs, however, co-op and condo sales in New York City picked up during the survey period, Richmond reported favorable readings on home sales in a few areas, and Kansas City reported that home inventories fell a bit in the Denver metro area. Weak home demand had mixed effects on conditions in rental markets: Chicago reported that builders' conversions of new homes to rental property put downward pressure on rents, while Dallas noted that demand for apartments picked up, in part because some potential homebuyers are unable to qualify for mortgages.

Beige Book - November 28, 2007

Desde meses atrás ya se anotaba el hecho de que el sector inmobiliario mostraba debilidad, aunque en junio de 2007 el informe señala que la economía sigue expandiéndose en la mayoría de sectores:

Reports from the twelve Federal Reserve Banks indicated that economic activity continued to expand from mid-April through May. Seven banks described growth in their Districts as modest or moderate: Cleveland, Atlanta, Chicago, St. Louis, Kansas City, New York, and San Francisco. Dallas reported growth as moderately strong, and Minneapolis said the District's economy edged up. Philadelphia reported that growth was somewhat faster than in recent months, and Richmond said growth picked up a bit. Boston characterized reports from its contacts as generally positive.

[...]

The real estate and construction industries were marked by continued weakness in the residential sector and increasing strength in the commercial sector. Most Districts characterized their housing markets as soft or weak. San Francisco reported that sales volumes for both new and existing homes fell further in most areas, with modest price declines in some parts of the District. Minneapolis described the District's housing markets as mostly weak, and Dallas described the District's housing markets as soft, noting high cancellation rates for new home sales in Dallas and continued slowing in the Houston market. Philadelphia reported no improvement in the housing market, and Cleveland reported that new home sales were stable but prices were down. Atlanta reported that sales stabilized at low levels in parts of Florida but continued to decline in Georgia. Reports from Richmond and St. Louis were mixed, with sales stabilizing or improving in some areas but declining in others. The most positive report on housing markets came from the New York District where there were signs of strengthening in New York City, parts of Long Island, and some close-in New Jersey suburbs. However, housing markets in the rest of the New York District remain sluggish. No District reported an increase in new home construction. Moreover, inventories and days on the market continue to rise in some Districts, although the Kansas City District has seen a reduction in inventories. Realtors in the Philadelphia, Cleveland, and Atlanta Districts anticipate that the weakness in the housing market will last several more months at least.

Beige Book - June 13, 2007

Observado en retrospectiva, es un documento que no va muy desencaminado sobre lo que ocurre en la economía estadounidense. A medida que la recesión se acerca, el Beige Book va aportando notas cada vez más negativas.

En definitiva, se trata de una fuente de información alternativa que resume las tendencias económicas más importantes de la economía. A pesar de que no muestra gráficas o no trata con estadísticas como tal, es un documento que transmite hechos y tendencias sin ruido estadístico, filtrados por un analista que selecciona lo que es significativo o merece ser señalado, añadiendo impresiones y datos cualitativos que reciben de sus fuentes. Es un buen resumen para obtener una visión general de cómo evoluciona la economía americana.

Contenidos relacionados:

El Efecto Ricardo y la Teoría Austriaca del Ciclo Económico

Indicadores del ciclo económico - La actividad del transporte