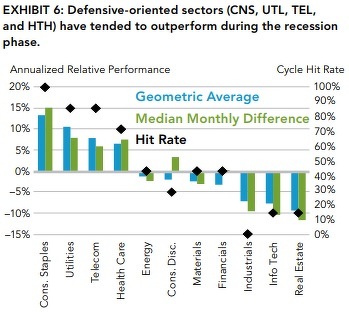

Some of the utility companies have evolved very well the last weeks, coincidentally at the same time than the global stock market has been doing it really bad, maybe the underlying reason is the defensive characteristic of these companies. In the past, this sector has performanced really well when global stock market has been in troubles (reference to the figure below). The figure above displays how utility sector with the consumer staples one have done a good performance whilst global stock market has been doing exactly the opposite.

The utility and consumer staples sector are tied more to basic needs and that´s the basic reason why they are less economically sensitive. We witnessed this really well in the technological bubble, the utility sector did performed well whereas most of the sector didn´t.

Next some utility companies’ charts and one of the consumer staples sector, GIS which is one of our favorites.

DTE Energy Company $DTE

Inverted Shoulder-Head-Shoulder

ED Consolidate Edison $ED

Envelope candle pattern from the bottom of the bull trend.

PPL Corporation $PPL

Break of the first major resistance

Duke Energy Corporation $DUK

Double Bottom

Entergy Corporation $ETR

Break of the first major resistance

Pinnacle West Capital Corporation $PNW

Break of the resistance line from the bottom trend

Public Service Enterprise group Incorporated $PEG

Throw back to the resistance after breaking

General Mills $GIS

Now because we are going to show you just one of the consumer staples sector, I am going to talk a bit about it.

General Mills has a P/E of 12 while the 5 years average is 22 the P/CF is 9 while the average is 13.5, the P/B is 4.3 while the average is 6.4.

If we just have a look at the ratios we will see that the shares performance is uncorrelated with the business but there is a good reason for that. GIS bought Blue Buffalo Pet Products, a high-end pet food brand. The investors think that GIS paid a high price for it (P/E 25), but if we have a look at the Blue Buffalo income statement we will see that it is not that expensive. Some of the peers are currently much more expensive than General Mills like Hormel foods corporation quoting in 25 price to earnings.

Buffalo Blue Income statement

Buffalo sales has grown 49% yearly from 2012, and Buffalo net income has grown 58% yearly from 2012. If the growth keep this trend, GIS really wouldn´t paid 25 earnings.

It´s not the first time GIS buys other companies, GIS is one of the oldest companies within the sector they have been growing by good decisions since the outset in 1920. If we have a look at the General Mills falls since 1980 we will get a reason why not to be afraid about the current shares performance.

Let´s think we have been always wrong at buying GIS shares from 1980, this is what comes after:

1977: GIS fell -44%

- 1977/1985 +8,5% yearly return

1992: GIS fell -35%

- 1992/2000: 6% yearly return

2000: GIS fell -30%

- 2000/2008: +7% yearly return

2008: GIS fell -43%

- 2008/2016: +16% yearly return

As we can see, It seems that big falls in General Mills are a good opportunity to buy. That´s exactly what we see currently in General Mills.

General Mills $GIS

Envelope candle pattern from the bottom of the bull trend.

I hope you enjoy it,

Regards,

Javier García Fernández